fulton county ga property tax sales

Atlanta Georgia 30303-3487. To review the rules in.

Douglas County Real Estate Douglas County Ga Homes For Sale Zillow

48-5-311 e 3 B to review the appeal of assessments of property value or exemption denials.

. Ad Find Tax Foreclosures Under Market Value in Georgia. 235 Peachtree Center North Tower. County Property Tax Facts Fulton On this page.

In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. 136 Pryor Street SW. In such case the Board of Assessors will notify each taxpayer of its decision to utilize the additional time.

Records and real estate services customer service. Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. Helpful Links Cities of Fulton County.

Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA. The Sheriff also conducts Delinquent Property Tax Sales.

OFfice of the Tax Commissioner. The 1 MOST does not apply to sales of motor vehicles. GET IN TOUCH WITH US Fulton County Sheriffs Office.

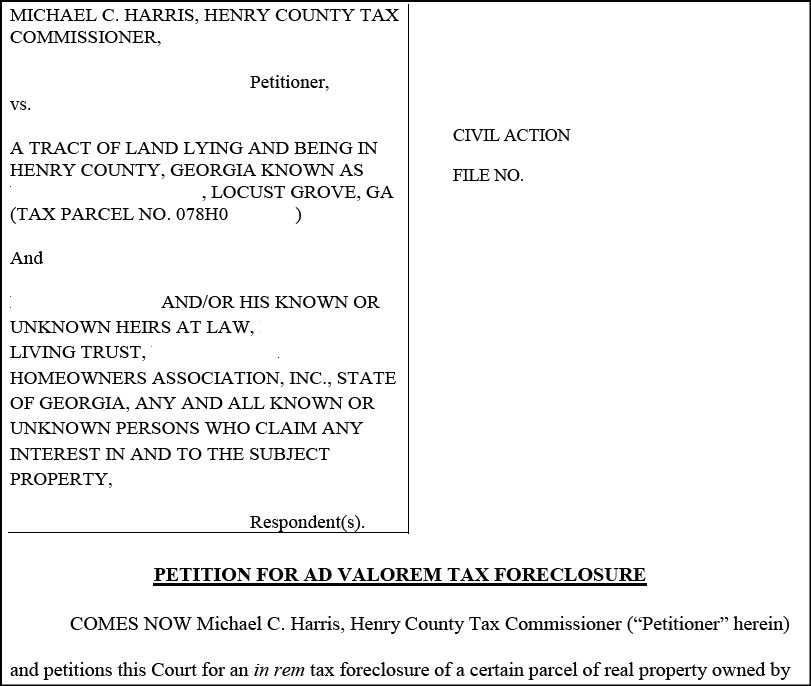

Search our database of Fulton County Property Auctions for free. Documents necessary to claim excess funds in Fulton County below are the instructions on submissions. If the process requires litigation you better solicit for help from one of the best property tax attorneys in Fulton County GA.

185 Central Ave 9th Floor. Taxpayer Refund Request Form. During the time the tax deed is still redeemable ie at least for the first year plus 45 days.

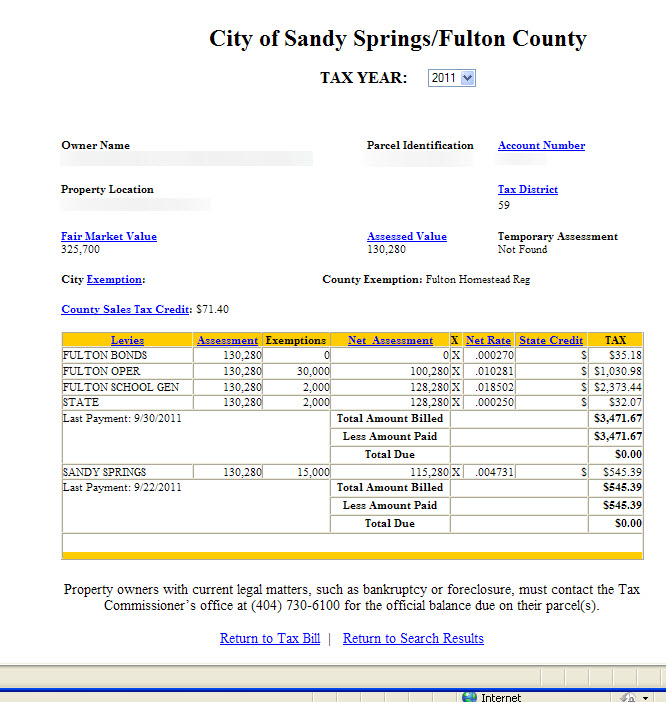

Sales Tax Rates - General. Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton County Tax Assessors office. Fulton County Property Records are real estate documents that contain information related to real property in Fulton County Georgia.

Surplus Real Estate for Sale Read More tax refund after lien sale Read More property and vehicles. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government Fulton County and City of Atlanta Schools the State of Georgia and the cities of Atlanta Mountain Park Sandy Springs Johns Creek and Chattahoochee Hills. Sales Use Taxes Fees Excise Taxes SAVE - Citizenship Verification.

They are maintained by various government offices. Tax Sales-Excess Funds Procedure Application. The 2018 United States Supreme Court decision in South Dakota v.

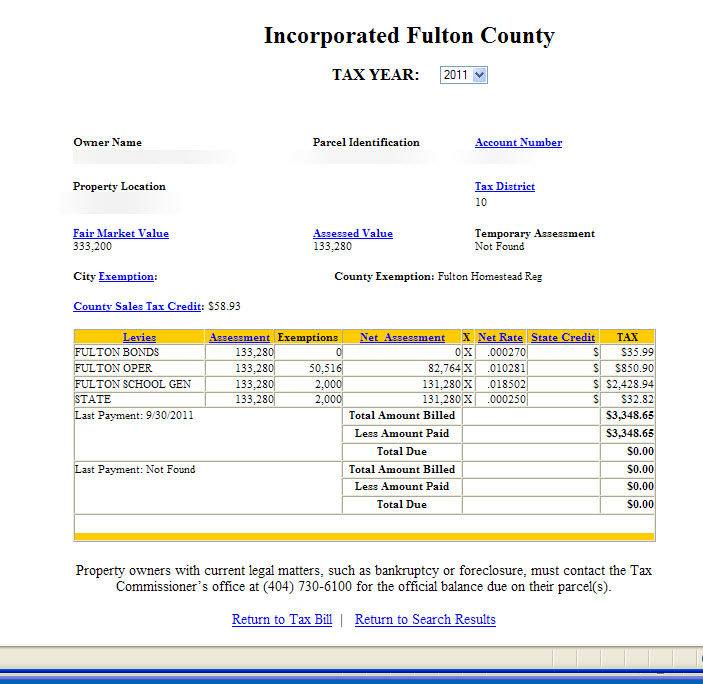

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100.

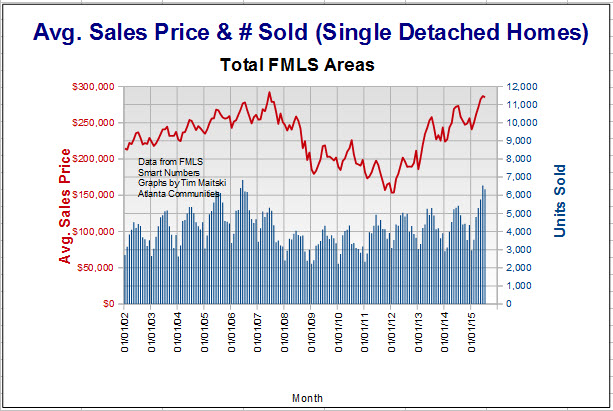

The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Substantiated data assessors have to operate when doing regular reappraisals are present-day sales stats. 7741 Roswell Road NE Suite 210.

That is just one example of sacrifices being made by members of the Fulton County Sheriffs Office. The Georgia state sales tax rate is currently. General Rate Chart - Effective July 1 2022 through September 30 2022 2166 KB General Rate Chart - Effective April 1 2022 through June 30 2022 2219 KB General Rate Chart - Effective January 1 2022 through March 31 2022 2217 KB General Rate Chart - Effective October 1 2021 through December 31 2021 22.

185 Central Ave SW Atlanta GA 30303. Find Fulton County Online Property Taxes Info From 2021. This process takes 45 days and once it is complete the tax deed buyer becomes the sole owner of the property and can take possession.

Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. 141 Pryor Street SW. Has impacted many state nexus laws and sales tax collection requirements.

901 Rice St NW Atlanta GA 30318. Find and bid on Residential Real Estate in Fulton County GA. These include basic homestead exemptions as well as homestead exemptions for seniors low income homeowners surviving spouses of public safety.

Ad Unsure Of The Value Of Your Property. Ferdinand is elected by the voters of Fulton County. The Fulton County Sales Tax is collected by the merchant on all qualifying sales made within.

All taxes on the parcel in question must be paid in full prior to making a refund request. Tax Commissioner Arthur E Ferdinand 141 Pryor Street SW Suite 1085 Atlanta GA 30303 Phone. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online distressed asset sales.

Fulton County lewis slaton courthouse Plats and Lands Records 404-613-5313 136 Pryor Street SW Ground Floor. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Clerk Land Records Webpage.

Please fully complete this form. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Fulton County Sheriffs Office.

Homestead exemptions are a form of property tax relief for homeowners. Fulton County GA currently has 3609 tax liens available as of July 7. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day.

The Fulton County sales tax rate is. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of median property taxes.

Mandated by Georgia law this process is designed to allocate the tax burden in an even way throughout. Surplus Real Estate for Sale. Email the Board of Assessors.

Fulton County Tax Commissioner Dr. Detailed listings of foreclosures short sales auction homes land bank properties. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Fulton County collects on average 108 of a propertys assessed fair market value as property tax. Please submit no faxesemails the required documentation for review to the following address below.

Find All The Record Information You Need Here.

Land For Sale In Atlanta Ga Sell Land In Ga Sh Consulting How To Buy Land Land For Sale Cheap Land For Sale

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Tax Sale Listing Dekalb Tax Commissioner

![]()

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Understanding Appealing Fulton County Property Tax Assessment Workshop Youtube

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

Georgia Relocation Guide Relocation Real Estate House Hunting

Judicial In Rem Tax Sales Gomez Golomb Law Office

2017 Kinderton Manor Dr Johns Creek Ga 30097 Realtor Com

Fulton County Property Owners Receive 2020 Property Assessments

Nc Fixer Upper Old Houses Old Houses For Sale Fixer Upper

Alpharetta Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Investa Services Of Ga Llc Tax Sale Case Gomez Golomb Law Office

7970 Rico Rd Chattahoochee Hills Ga 30268 Realtor Com

Fulton County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

257 Oakcliff Atlanta Ga 30331 Oakcliff Road Property Loopnet

Rent To Own Homes Nearby Snellville Ga Rent To Own Homes Home Franklin Homes